Sponsorship Essentials: Q&A w/ Thomas Wills, CEO of BWA

Thomas Wills is the President and CEO of Bonham/Wills & Associates. By 30, he was heading up one of the bigger players in the sponsorship, valuation, and negotiating world. Today, in part one in our series, "Sponsorship Essentials", he sits down with us and lends us valuable insight into the sponsorship and naming rights industry, (all done in 10 minutes or less).

By: Claire Lingley

Thomas Wills is the President and CEO of Bonham/Wills & Associates. By 30, he was heading up one of the bigger players in the sponsorship, valuation, and negotiating world. Today, in part one in our series, "Sponsorship Essentials", he sits down with us and lends us valuable insight into the sponsorship and naming rights industry, (all done in 10 minutes or less).

Q: How did you get into this business?

A: Out of university I had the unique opportunity to work with an industry professional, that being Dean Bonham, who has been a titan in the naming rights world for the last 30 years. He brought me on to work on 2 projects, one of which being a project in Ottawa and the other with the University of Pittsburgh. And really, it just grew organically from there. Although my background was medical sciences, I was able to use a lot of the process information that I learnt during my studies in our valuation and analysis system.

Q: Any advice for someone trying to enter the business?

A: Know your market, and understand that it is a business and that it is not just sports. A lot of people enter the sports industry with the idea they are going to be working in player personnel. At the end of the day, that is not the case. This is marketing, this is sales, this is a business.

Q: BWA specializes in negotiations, any tips for when you’re entering the room?

A: Listen.

Q: Anything else?

A: Keep listening! Also, it is key to understand from the onset of any negotiation that the most successful negotiation is one in which both parties leave satisfied. You will not have continued success in this industry if you try to have one over on the opposing party. Finding the best, fair, and most creative solution is always the goal.

Q: Where do you see naming rights going in the next 5 years?

A: In 2013, we predicted that naming rights were going to spike in 2018 through 2022. We still believe this. And now we have a prediction that naming rights are going to continue to move out of the traditional sports and entertainment venues, and into more cultural and municipal properties. Furthermore, collegiate naming rights are going to increase, with brands expanding their reach with full-bodied packages that interact with students, fans, alumni, etc., enhancing fan experience and further assisting corporations in growing their revenue. The days of just throwing a corporation's name on the side of the building will soon be behind us.

Q: Any inside scoops on untapped markets? You mentioned cultural and municipal properties, what’s one type of property that you think would be great for naming rights and hasn’t been discovered yet?

A: I think transit systems are going to peak. People use these systems every day, and there is a lot of room and potential for naming rights within that industry to grow and expand. I think corporations are going to integrate their technology and enhance the experience of users on a day-to-day basis, which will in turn drive sales and revenue for that corporation.

Q: What’s the best piece of advice you’ve ever received?

A: There’s a saying out there, and I’m not sure how it goes, but I’m a true believer that success is 90% about luck. The more I work, and the harder I work, the more luck I seem to have.

Q: Last question, statement tie or statement socks?

A: Statement socks.

Corporate Sponsorship and School Districts

A lot of times, when partnering with a school district the exposure will extend throughout the high school campus parks and facilities increasing the ability to reach every resident within the district. This creates a real win-win opportunity for quick return on investment.

For years, all across North America, we have seen school district funding fluctuate with the economy. Loss of programs, overcrowded class rooms and outdated facilities have been just a few of the issues many districts have been facing. In the early 2000’s, we really stared to see a trend taking off. The success found for both corporations and school districts through sponsorship has continued to propel like-minded groups to follow suit.

In the past many have looked at these types of partnerships with skepticism, most worrying about oversaturating our schools with corporate initiatives. As these relationships have become more popular, we have seen a drastic shift in perspective and with this shift has come a rapid increase in benefits for both parties involved and their surrounding communities.

One of the trendsetting districts to increase revenue through corporate partnerships was a school district in Indiana. “The nonprofit Penn-Harris-Madison Education Foundation has signed deals that will bring the school district, which includes 11 public high schools in Northern Indiana, more than $600,000 in added revenue in the coming years. The district sold off the naming rights to football stadiums, baseball fields and even a music room”. (Chicago Tribune)

There is an undisputable increase in visibility for corporations within this industry and in turn a massive increased local customer base. The ability to tailor involvement and specifically target demographics, corporations are creating new exposure elements implementing more activation, and in turn maximizing brand awareness of products and services. Additionally, the corporation also gets real chance to make a difference by committing much needed funding to help enhance the community in which they serve.

Back in 2004 Judith Thomas, marketing director for the National Federation of State High School Associations stated: “Corporate involvement at the high school level is about to explode nationwide. It is an unlimited, untapped market and it is in places companies often can’t easily reach (” Pennington”).

In 2005 When Safeway donated $50,000 to a San Francisco School District after around 200 teachers were laid off, their Public Affairs manager Teena Massingill stated: “Giving back to the community is a pleasure and a responsibility,” (McCollum”).

A lot of times, when partnering with a school district the exposure will extend throughout the high school campus parks and facilities increasing the ability to reach every resident within the district. This creates a real win-win opportunity for quick return on investment. Beyond the benefits listed above, corporate partners truly get a chance to make a difference by benefiting not only the community but also the students through the creation of scholarships, mentoring programs and increased fundraising efforts/opportunities. Residence of the community (consumers) will take all of these elements into account when forming opinions about corporate sponsors.

For example, Sweetwater Union High School District, in the San Diego area, has made sponsorship contracts with nearly 300 national and local businesses. This money has gone directly into their sports programs, specifically creating freshman teams and allowed for intramural teams to develop at the middle school level, (“McCollum”).

Moving forward we hope to see this industry trend continue to grow alongside the communities they reside in.

San Jose Spartan Stadium Now Named After Credit Union!!!!

SAN JOSE -- With its plan to rename Spartan Stadium after a credit union in exchange for $8 million, San Jose State joins a growing number of universities nationwide striking lucrative corporate deals to rebrand athletics facilities.

http://www.mercurynews.com/bay-area-news/ci_30214706/san-jose-states-spartan-stadium-now-named-after

By Hannah Knowles, hknowles@bayareanewsgroup.com

SAN JOSE -- With its plan to rename Spartan Stadium after a credit union in exchange for $8 million, San Jose State joins a growing number of universities nationwide striking lucrative corporate deals to rebrand athletics facilities.

The partnership, which California State University trustees approved last month, will turn San Jose State University's football and soccer team turf into "CEFCU Stadium — Home of the Spartans," or just "CEFCU Stadium." That's short for Citizens Equity First Credit Union.

While other California schools have entered similar deals for smaller sports centers like basketball arenas, SJSU will be the first NCAA Division I school in the state to sell naming rights for its stadium to a company. San Diego State's football team plays in a stadium named for the tech company Qualcomm, but the school does not own the venue and shares it with a pro team, the San Diego Chargers.

Traditionally, universities name arenas and stadiums after big donors, notable staff or simply after the institution itself, but corporate naming -- ubiquitous among professional sports facilities -- is on the rise among colleges.

"We're constantly looking for corporate partners and sponsorship opportunities, and that's an expanding area only limited by one's imagination," said Gene Bleymaier, SJSU's director of athletics.

CEFCU will give the university $8.6 million to support the SJSU athletics department through scholarships, improvements to facilities and other programs. The payment is spread out over the 15-year agreement, starting this school year with $450,000 and rising annually to adjust for inflation.

SJSU's stadium partnership is part of the school's broader push to find new sources of revenue, both philanthropic and corporate -- not just in athletics but for the university as a whole, said Paul Lanning, vice president of university advancement.

"Universities and colleges are seeking ways to continue to augment constrained budgets," Lanning said. "Public-private partnerships like this one -- they're going to be a very important element of our strategy going forward."

The strategy extends beyond athletics. Recently, SJSU entered a five-year agreement with Cisco Systems worth $1,050,000 to name a laboratory and professorship in the College of Engineering.

Lanning said that the university's budget is in "good shape," having stabilized since a last-minute scramble for budget cuts in 2013. But state funding can't cover all of SJSU's needs, he said, especially as the CSU system grapples with growing demand.

The CEFCU deal, SJSU's largest corporate sponsorship to date, will help restore an aging stadium to top shape with improved concessions and amenities for spectators. It will also help cover new costs in the athletics department caused by a change in NCAA rules last year that meant the university needed to contribute about $1.6 million more per year toward sports scholarships. The NCAA expanded the definition of an athletic scholarship to include travel expenses and other miscellaneous items, which effectively raised the amount of money that schools are allowed to provide their players. Currently, SJSU is tapping general university resources to provide those extra dollars.

SJSU found CEFCU through a third party, a sports consulting company called Bonham/Wills & Associates that specializes in naming deals. CEFCU has been a lower-level Spartan Stadium sponsor since 2011, one of over 100 sponsors at various levels throughout the entire SJSU athletics department.

While some cash-strapped colleges have embraced brand names from AT&T to Papa Johns for their stadiums, other universities have shied away from the corporate trend and turned down millions of dollars. In 2007, shortly after University of Minnesota debuted TCF Bank Stadium in return for $35 million, officials at Notre Dame University and Michigan State University told Sports Business Daily that they would not follow suit and wanted to maintain a strictly collegiate image.

Other schools in Bay Area feel similarly. Stanford avoids corporate signage for its sports venues. Santa Clara University has none either. UC Berkeley has no plans to sell naming rights to Memorial Stadium, even as it struggles with debt after spending $321 million to upgrade the venue, which a study deemed unfit to weather earthquakes. A school spokesperson said that the Memorial Stadium name is "essential to the history and traditions of the university."

However, UC Berkeley welcomed a corporate sponsorship similar to SJSU's in 2013, a year after completing the stadium renovation. The school made a 15-year, $18 million deal to rename the playing field inside the stadium after Kabam, a video game company with three UC Berkeley alumni among its cofounders.

SJSU will debut the new name at its first home football game Sept. 10 against Portland State.

Some worry that SJSU's stadium name change will undermine the Spartan tradition.

"We take pride in where we went to school, and when you start seeing names that really do not go with the university, I think it takes away from the teams," said Judy Najero ,who graduated from SJSU in 2004 and works in San Jose. "I think you're going more toward the dollars than the education or what makes up the Spartan community, which is the alumni, the students and the staff."

Bleymaier said that the athletics department weighed these concerns but believes the sponsorship will only enhance the sports program And, as Lanning pointed out, the stadium's official title still includes "Home of the Spartans."

"We understood that change can be difficult," Bleymaier said. "But looking at the environment and the need to generate new money is not something that's new to colleges."

Corporate Sponsorship of Municipal Properties

Over the years, municipal and public facilities such as parks, beaches and sporting facilities have witnessed a decline in government funding which as a result has led to difficulties in conducting maintenance and upkeep.

In order to combat this, properties have historically looked towards donors and more recently, corporate sponsors. This brings up an interesting debate about over-corporatization, with commentators on both sides of the fence making their opinions heard, including prominent personalities like Bill Maher in this video.

Over the years, municipal and public facilities such as parks, beaches and sporting facilities have witnessed a decline in government funding which as a result has led to difficulties in conducting maintenance and upkeep.

In order to combat this, properties have historically looked towards donors and more recently, corporate sponsors. This brings up an interesting debate about over-corporatization, with commentators on both sides of the fence making their opinions heard, including prominent personalities like Bill Maher in this video.

Now, while we won’t comment on the political aspect of this debate (we’re a marketing firm!) what we can comment on is public perception on this issue and how facilities can pursue corporate sponsorship whilst shielding citizens from overt and intrusive branding. On the other side, we think that corporations can benefit immensely from this practice and can increase their presence amongst consumers without being invasive. If done correctly, it can be a win-win for both sides and will keep the general public happy.

To begin with, let us begin be examining how public attitudes towards sponsorship of park facilities has changed. In 2014, IEG published results from a research study conducted by Virginia’s Fairfax county park authority. The key takeaways from the study included perceptions on the kid of facilities that should pursue sponsorship and the overall levels of support/opposition to facilities pursing sponsorship. They are listed as under –

- Support for sponsorship is high and has increased over the years

- That being said, there are still concerns over commercialization

- Pursuing sponsorship and Naming Rights deals is considered acceptable depending upon the type of venue/facility

- Coupons and special offers for park users and logos on publications are appropriate forms of sponsorship activities

- Of course, the industry categories that are considered appropriate also differ with regards to the type of property. In the case of parks, sporting goods and home and garden categories were considered most appropriate

- People are for sponsorships if it is eased into and is done tastefully

Although, this study was done on a small scale, the results do show promising signs for corporations. Although tasteful and understated execution of activities may not provide corporations with the same high profile that they receive from sponsoring, lets say a major stadium, what it does provide is a boost in local presence and an unobstructed share of mind, which can prove to be valuable.

As far as the park authorities are concerned, it will help inject much needed funds in a system that, as analysts predict, currently needs $12 billion dollars (in the USA alone) worth of repairs across the board. It doesn’t help that the US Congress set an annual budget of only $2.85 billion this year. While facilities may not be able to raise such high levels of cash from sponsors, it will be a start. They also need to make sure that activation is done right. For example, by putting up North Face branded trail markers in some parks, Virginia is showing how it can be done.

So what is our verdict? We feel that the hyperbole around inappropriate sponsors is a little unjustified and parks and municipal facilities can pursue sponsorship in a successful, yet tasteful way.

BWA has worked with and continues to work with numerous municipal properties in order to help them achieve their sponsorship goals.

$$$ Dollar for Dollar $$$

Naming rights occupy the highest point on the sponsorship pyramid and typically carry with them a number of major benefits for all parties included. This is why we will continue to see these investments increase across industry categories, sports and entertainment venues, events and properties around the globe.

Viewing sponsorship as a cost-effective method of achieving specific marketing objectives, has been the driving factor behind the dramatic increase in Naming Rights over the last decade. Sponsorship marketing is particularly valuable because of its effectiveness in introducing new products, helping new or established products contend with competitive brands, and increasing corporate brand awareness. Increasing brand awareness is a primary factor behind a significant sub-trend within the sponsorship industry over the last several years. It has been proven that "Dollar for Dollar" Naming Rights is the best investment a corporation can make.

Corporate Benefits

- Enormous brand exposure

- Strong connection to iconic civic facility

- Demonstrate commitment to community

- Increase sales through direct access to property's audience and prime hospitality opportunities

- Ability to target specific demographic groups/audience

- Credibility (sponsorships have greater credibility than straight advertising)

- Interactive marketing platform

Property Benefits

- Generate immediate and annual revenue

- Build image/profile of property through linkage with prestigious corporate entity

- Create marketing synergies for an expanded marketing reach

- Eliminate various line-item expenses

General Naming Rights Benefits

- Impactfull branding exposure

- A prestigious association with the property and its tenants

- the ability to rise above the advertising clutter normally associated with sports and entertainment properties

- The opportunity to pre-empt a company's competition from an association with the property

- The potential for lucrative direct and indirect business relationships

Naming rights occupy the highest point on the sponsorship pyramid and typically carry with them a number of major benefits for all parties included. This is why we will continue to see these investments increase across industry categories, sports and entertainment venues, events and properties around the globe.

Naming Rights, A Trip Down Memory Lane.....

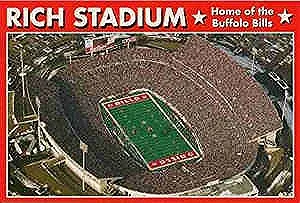

Though the origin of naming rights may be debated, certainly a watershed moment in their development was the 1972-73 naming rights agreement between Rich Products, a Buffalo food manufacturer, and Erie County which enabled the former to put its name on a new football stadium in Orchard Park, New York, the home of the National Football League’s Buffalo Bills. The agreement called for Rich Foods to pay $1.5 million over 25 years in exchange for signage at the stadium and a commercial association with the franchise.

Though the origin of naming rights may be debated, certainly a watershed moment in their development was the 1972-73 naming rights agreement between Rich Products, a Buffalo food manufacturer, and Erie County which enabled the former to put its name on a new football stadium in Orchard Park, New York, the home of the National Football League’s Buffalo Bills. The agreement called for Rich Foods to pay $1.5 million over 25 years in exchange for signage at the stadium and a commercial association with the franchise.

The naming rights phenomenon continued in northern New York when Carrier Corporation, a maker of heating, ventilation, and air-conditioning equipment and refrigeration systems, concluded an agreement with Syracuse University in 1979 to name the school’s new athletic facility. Then, in 1986, Pilot Air Freight purchased the naming rights from the City of Buffalo for the new stadium that housed the Buffalo Bisons, a minor league baseball team.

About this same time, California-based Arco Oil bought the naming rights to the new arena in Sacramento that would be home (Arco Arena) for the Sacramento Kings of the National Basketball Association. In 1988, Great Western Bank became the first company to re-name a facility, theForum in Los Angeles, which was then the home court of the Los Angeles Lakers.

Interest in naming rights really began to gain steam in the 1990's when a slew of professional facilities, starting with the Target Center in Minneapolis (home of the NBA Minnesota Timberwolves), hastened to adopt corporate monikers. Not surprisingly, the fees associated with these sponsorship's also increased—in some cases dramatically.

In the last 15 years, the corporate interest in naming rights has shown no signs of letting up. Based on the latest public information, there are now 113 naming rights agreements currently in place for major league facilities in North America alone, and more than half of them have been done in the last decade. In addition, there are scores of naming rights deals for minor league and collegiate facilities, convention centers, amphitheaters, theaters, even high school stadiums.

Sponsor Logos on NBA Jerseys: What Do We Think?

Financially speaking, this is a welcome addition to the league; however, one also has to analyze what fans are thinking and social media sentiment around this issue is rather divisive. We gather that the the outrage is gathered around two main issues, namely –

The NBA recently approved a three-year pilot program that will allow for a 2.5-inch by 2.5-inch advertising space on team jerseys to be sold to sponsors who can then put their logo. The NBA have already experimented with this in the 2016 All-Star game which featured team jerseys with the Kia logo on a the front left opposite the jersey manufacturer’s logo.

Teams will have to sell this space on their own and will have to put half of the revenue generated in the league’s revenue sharing pool. According to industry estimates, this initiative will generate $150 million in additional annual revenue. Obviously, teams with a more global presence and probable playoff appearances will end up selling the space for higher rates, but that being said, this will help do wonders for some smaller, less successful teams.

Financially speaking, this is a welcome addition to the league; however, one also has to analyze what fans are thinking and social media sentiment around this issue is rather divisive. We gather that the the outrage is gathered around two main issues, namely –

Sponsor logos will be intrusive and will make affect the aesthetics of the jerseys, making them look more like motorsport overalls.

While soccer teams have had sponsor branding on their jerseys for a long time, it makes sense for them considering they have only commercial break during half time. On the other hand, NBA games have more breaks, including timeouts.

While these concerns are legitimate, here are our thoughts on the matter –

When speaking about aesthetics, one thing that fans have to remember is that this will be a rather small patch and will not be intrusive. Soccer jerseys naturally allowed for significant sponsor branding simply because club logos have traditionally been in the form of small crests placed on the top left of the jersey. Because NBA jerseys have never accounted for significant branding before, it would mean that the team’s branding would have to be reduced. And that is not something that any team is going to stand for, simply because teams have been present for a long time during which, they have built up a significant amount of brand value. Any major change to jersey designs would result in a drop in that value and that’s not what any team wants. So fans can rest easy that the addition of a small patch will be done tastefully and will definitely not result in the jersey looking like motorsport overalls.

Secondly, ask any person who is a fan of both soccer and basketball (and we have a few within BWA), basketball is definitely a much easier sport to watch either live, or on the television, simply because the commercial breaks allow for more opportunities to get up from one’s seat and not miss out on the in-game action. The risk of leaving one’s couch to fetch a cold one from the fridge is definitely a lot higher in soccer.

Lastly, if fans are still worried about having their team jerseys with logos stitched on, they have to remember that the NBA’s merchandise division will still be selling the jerseys without the patches. The jerseys with the sponsor branding will only be available through the teams’ official store.

The final word: Change such as this has always been inevitable and in time, the fans will get used to it and will grow to accept it. And to this, we’d like to give the example of FC Barcelona. The Catalan soccer team has some of the most loyal and devoted fans amongst all sports teams in the world and had always snubbed jersey sponsorship till 2006 when they signed a deal with UNICEF. As part of the deal, the club also donated €1.5 million to fund, which seemed to appease the purists who were extremely opposed to the deal. After this deal expired, the club signed a deal with Qatar Sports Investment worth €150 million. This decision was met with surprisingly little opposition from the club’s fans. Thus, in time, this phenomenon will also gain acceptance from the league’s fans.